Cross discipline hydrocarbon allocation

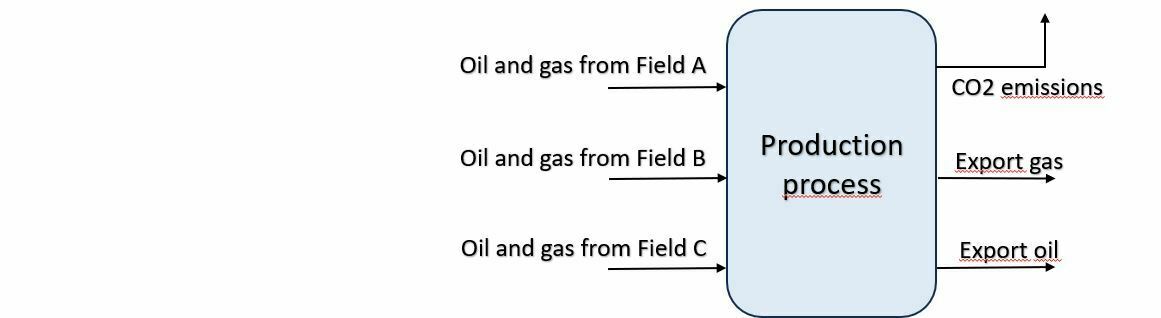

Illustration of three fields producing oil and gas to the same production process

In the petroleum industry, many fields consist of a production platform with one or more satellite subsea fields tied back to the same production platform. Focus on cost-effective developments of new hydrocarbon fields aims at exploiting the capacity of existing production units to the maximum. Thus, the majority of new developments involve tie-backs where the satellite may have a different ownership structure than the mother field. Both fields produce multiphase (oil, gas and water) flow into the same production process. Thus, the oil and gas exported from the production platform will consist of oil and gas from both fields. This generates the need for a more in-depth understanding of field and ownership allocation and its effects on the exposure to loss of revenue for each of the stakeholders. As allocation agreements directly affect the cash flow, it is important that the allocation agreement is fair and adequate and that the uncertainties in field and ownership allocated quantities are well understood and accepted by all involved parties. In addition, it is important to understand how selection and procurement of metering instruments (CAPEX), together with follow-up on metering stations (OPEX) affect the allocation uncertainties.

In order to address the field and/or ownership uncertainties and exposure to loss of revenue related to the allocation system, uncertainty calculations at system level are required. This involves several metering stations, production profiles, compositions, process parameters, system setup and allocation methodology among others. Performing an allocation and ownership uncertainty analysis analytically and/or manually rapidly becomes unfeasible, as the systems grow more complex. For systems with several tie-ins and satellites, and with a fragmented ownership, powerful numerical methods are required to perform this analysis.

The overall objective of this Joint Industry Project (JIP) was to establish a foundation for industry best practice related to allocation uncertainty and risk-cost-benefit calculations. The foundation was based on 1) in-depth studies of relevant allocation challenges based on studies of several representative allocation systems, 2) an increased understanding of how fluid phase transitions can be modelled adequately for allocation uncertainty studies and quantify how fluid phase behaviour affect the allocation uncertainty, and 3) investigating the relation between allocation uncertainty and financial risk exposure.

The project developed a report summarizing the findings, conference papers at the North Sea flow meas. workshop 2021 and the NFOGM Hydrocarbon Management Workshop 2023, and an Excel tool for simplified allocation uncertainty analysis.

The project was funded by DNO Norge AS, Wintershall DEA and Lundin Norway AS.

A new Joint industry project (JIP) to continue the work and further increase the knowledge of the complexity in allocation situations is being discussed. Interested companies may contact project manager Marie Bueie Holstad.

Project Facts

Status

CONCLUDED

Duration

01.08.19 - 31.12.22

Location

Bergen

Total Budget

3.000.000 NOK

Coordinating Institution

NORCE